India is amidst a monumental energy transition—with global consequences. India's population is primed to continuously grow, industrialize, urbanize, and electrify their lives. Over the next two decades, it will urbanize 300 million people, double building space, add 640 million air conditioning (AC) units, and add 240 million road vehicles. During this period, India's new total energy demand will be 25% of the global increase in total energy demand.

Meeting India's doubling electricity demand will require adding power capacity equivalent to the European Union's (EU) entire power system today. Consequently, how it chooses to meet its future energy demand growth will have profound global environmental and market implications.

India has set an ambitious renewable energy (RE) target of 450 GW by 2030. Meeting the target will require $600 billion in financing for new generation and grid infrastructure, including $200 billion for photovoltaic (PV) and wind capacity. The required new financing dwarfs present sector capital flow. Mobilizing increased capital will only be possible if stakeholders are confident, they can navigate the sector's significant investment risks.

A recent paper ‘Strategic investment risks threatening India's renewable energy ambition’ reviews strategic investment risks in India's renewable energy sector and discusses investment risk mitigation strategies.

The paper published in the journal on ‘Energy Strategy Reviews’ has insights distilled from interviews with leading sector investors, Independent Power Producers, and policymakers. The analysis is relevant to emerging markets with power sector structures.

Rapid massive deployment of renewable energy (RE) has emerged as the centrepiece of India's energy transition strategy. RE offers India persuasive advantages versus its historical paradigm of burning imported coal: reduced electricity costs, reduced current account deficits, increased energy security, pollution mitigation and a pathway to deliver on its global climate commitments.

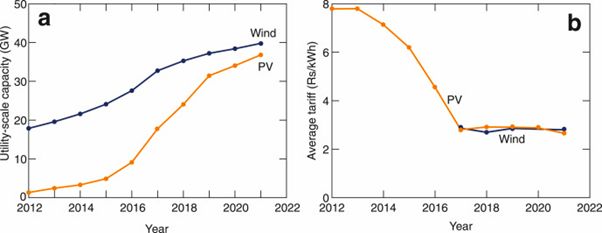

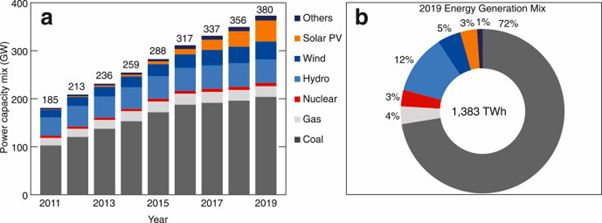

Policy pulls and market forces have unleashed rapid RE progress with cumulative installed PV and wind capacity at 46 GW and 40 GW, respectively. Concurrently, average utility-scale PV and wind tariffs have dropped, respectively, by 66% and 27%.

While coal still dominates India's total power capacity and energy generation mix, PV and wind's combined share of power capacity has surpassed 20%. India's installed PV and wind capacities are the fifth and fourth largest in the world, respectively. Recent RE tariffs of Rs 1.98–3.0/kWh ($0.03–0.04/kWh) are among the world's lowest.

All eyes are watching India navigate its energy transition. Sector financing must scale rapidly to meet this target. Mobilizing needed capital will be difficult given the complex renewable energy (RE) sector investment risks.

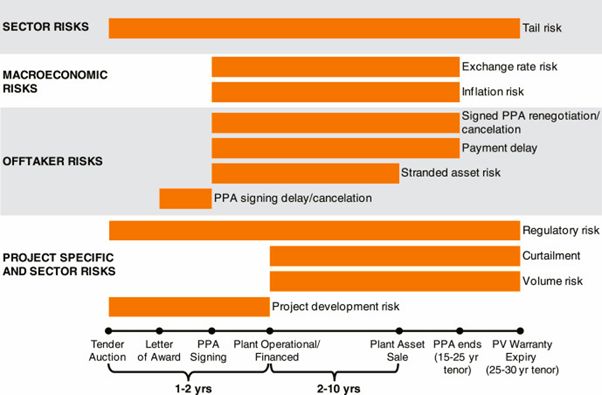

The financial distress of India's DisComs is emphasized in the paper along with its troubling impact on RE investments. Subsequently, nine strategic sector investment risks and corresponding mitigation strategies are discussed: project development risk, offtaker risk, stranded asset risk, volume risk, curtailment, regulatory risk, inflation, exchange rate risk, and tail risk.

The paper details offtaker risk, the most significant risk. Risks derive from politicization of the power sector, poor legal contract enforceability, a competitive market environment of rapidly falling RE tariffs, and inflexible power procurement models. These have led to a status quo where project execution is difficult, and DisComs have neither the ability nor incentive to make timely payments, honour contracts, and facilitate private distributed RE projects.

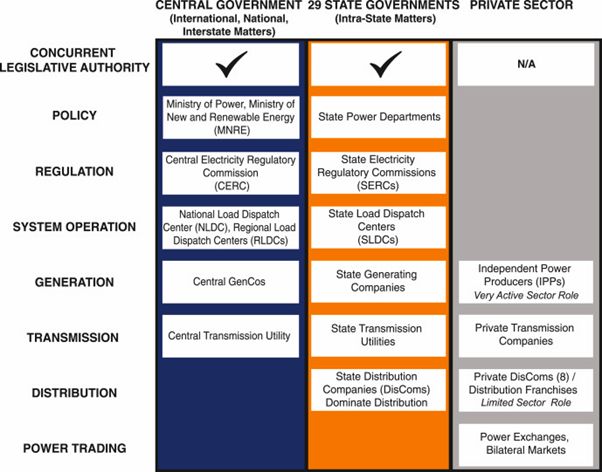

Prior efforts to reform DisComs–including three bailouts in the last eight years–have failed to make lasting improvements because the centre has limited constitutional ability to unilaterally reform the power sector. It instead can only rely upon its soft power to incentivize or coax states to reform.

Central offtakers now dominate utility-scale auction capacity as intermediaries to insulate IPPs from directly contracting with risky DisComs Presently billions of dollars have been invested in this large market for 7–9% USD returns and growth opportunities.

Current investors, however, are neither investing at the levels nor the rate required to meet India's 450 GW target. The ultimate resolution to offtaker/stranded asset risks would be a combination of major policy reform and adoption of more flexible power procurement models. How, if, and when these transpire remains uncertain.

The trajectory of new RE project tariffs (i.e., continuing fast declines) will shape future PPA signing delay/renegotiation and stranded asset risks. Tariffs will be determined by PV module costs and financing costs.

Present drivers for higher module costs are inflationary pressures, supply-chain bottlenecks, silver price increases, module made-in-India auction requirements, and announced 40% import duty. Competing drivers for lower module cost are PERC technology improvements and manufacturing scale-up, and fierce manufacturer competition. Financing costs will be determined by evolving international/domestic interest rates, plus the sector risk premium.

The full paper can be accessed here